Pay Your Tax to Hold Government Accountable – SOIRS Boss Urges Citizens

This post has already been read at least 111273 times!

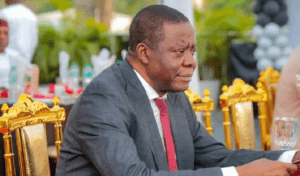

The Sokoto State Internal Revenue Service has enjoined the people in the state to pay their tax so that they can make government accountable to them, says the Chairman, Sokoto State Board of Internal Revenue Service (SOIRS), Alhaji Aminu Dalhatu Zurmi at the First Joint Trade Fair of Sokoto, Kebbi and Zamfara states.

Alhaji Dalhatu Zurmi noted that it is only when people pay tax that they can expect any meaningful development from government.

According to him, “in time past, we rely on Federal Allocation through the sale of crude oil, which is our major income earner, but you can see, a lot of things has happened in the world, including the pandemic, the global recession, all these have resulted in small revenue accruing into the Federation Account, which in effect also affects States.

“That is why government now is looking inward to call on citizens, who owns businesses, or those who are employed or who do legitimate business to come forward and contribute to the payment of taxes for the betterment of Society.

“This message, am passing it on behalf of the Executive Governor of Sokoto State, His Excellency, Governor Aminu Tambuwal”, he said.

On revenue drive, he noted that “there is great transformation in the new Sokoto State Internal Revenue Service, one of which is that the government has reviewed and passed into law, the Sokoto State Internal Revenue Law 2019 (the Sokoto State Integration and Consolidation).

“This Law repeals all previous Tax and Revenue laws in the state and local government areas of the state – which has not been reviewed in the last thirty years.

“The rates and fees payable are being reviewed upwards, though the revenue collection rate in Sokoto is one of the lowest in Nigeria, at the same time, it has helped to increase the profile of revenue collection of the state.

“These, we are proud of and we shall continue”, he added.

Explaining further, Alhaji Zurmi, said the law, as integrated, is in collaboration with the state and local governments, “so we are working in conjunction with the 23 local government in the state with a view to harmonize their collections but for the purpose of collection reporting only.

“Whatever is due to the local government goes to the local government.we have identified those areas and have included it into the new laws that will help both the state and local government in the collection of revenue.

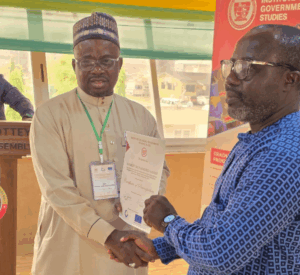

“Our participation in this trade Fair is one of the avenues that we take advantage of to sensitize the General public on the essence and reason why they should pay tax and we will continue to engage and enlighten people in this direction”, Alhaji Dalhatu Zurmi explained.

This post has already been read at least 111273 times!