Amid New Naira Notes Scarcity Abuja Residents Reject Old Notes As Malami Says FG Will Obey S’Court Ruling

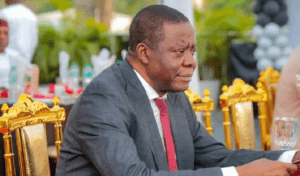

Attorney General of the Federation (AGF) and Minister of Justice, Mr. Abubakar Malami, has said while the federal government would obey the ruling of the Supreme Court Of Nigeria, which put on hold the the deadline fixed by Central Bank of Nigeria (CBN) for old naira notes swap, adding that the government would take necessary steps to set aside the interim order.

This is even residents of the Federal Capital Territory (FCT), Abuja, began rejecting the old naira notes on Friday, February 10, 2023 amid uncertainty over the enforcement of the February 10 deadline for the old 200, 500, and 1000 naira notes to stop being legal tender in Nigeria.

The Supreme Court of Nigeria had in a ruling on Wednesday ordered the suspension of the CBN deadline for the demonetisation policy.

The order was issued during a ruling on an ex parte application brought by Kaduna, Kogi, and Zamfara states against the AGF in the case of Attorney-General of Kaduna State & 2 Ors. v. Attorney-General of the Federation (Suit No: SC/CV/162/2023) pending at the Supreme Court.

They had asked the court to issue an interim injunction against the government, pending the hearing and determination of their suit challenging the naira redesign policy of the CBN.

The three states argued, among others, that the policy had brought an excruciating situation upon the country and unless the Supreme Court intervened timeously there might be anarchy in the country.

According to them, since the announcement of the policy, there has been an acute shortage in the supply of the new naira notes in their states, thereby making it very difficult and nearly impossible for citizens to access the new notes.

While they argued that the notice period given by the federal government was inadequate, they claimed that the CBN did not follow laid down procedure for implementation of the policy.

In a short ruling, the apex court granted the interim order and restrained the federal government from banning the old naira notes, pending the determination of the suit.

Hearing on the matter at the apex court was fixed February 15.

However, Malami clarified during an interview on ARISE News that the federal government, out of its regard for the rule of law, would abide by the order of the apex court, even though it intended to challenge it and would do so within the provisions of the law.

The comments by the minister came as it was gathered that the federal government had filed reasons before the Supreme Court as to why the suit by three states challenging the February 10 deadline fixed by the CBN for phasing out the old N1, 000, N500, and N200 banknotes should be struck out.

Meanwhile, the CBN had attributed the continued scarcity of new banknotes to hoarding in certain quarters.

The CBN is yet to issue a statement on the deadline at the time of this report.

Malami Assures Federal Government To Obey S’Court Ruling

But reacting to the interim order of the apex court, the AGF stated that it was within the right of the government to challenge any order it was not pleased with.

He said the government would do so in this matter using the instrumentality of the law.

Malami stated, “The rule of law provides that there has to be obedience to the judgement and orders of the Supreme Court.

“The rule of law provides that when you are not happy with a ruling you can file an application for setting it aside and in compliance with the rights and privileges vested in us as a government, we are equally looking at challenging the order and seeking for it to be set aside”, Malami said.

He disclosed that the federal government had already put machinery in place to challenge the jurisdiction of the apex court to hear the suit of the three states.

He contended that the singular fact that the CBN was not joined as a party in the suit robbed the apex court of necessary jurisdiction.

He said when the court reconvened next Wednesday, the federal government, on one hand, would be challenging the jurisdiction of the apex court to entertain the suit, and on the other, see how the interim order would be vacated.

He said, “The order was granted by the Supreme Court and the order incidentally lapses on Wednesday, which is the day of the hearing, with that position in mind we have taken steps to file an objection challenging the jurisdiction of the court to entertain the matter.”

The minister explained, “Jurisdiction on the grounds that when you talk of monetary policy, regardless of the characters they take, the central bank is an indispensable and a necessary party for that matter.

“What we have at hand is a situation where the central bank was not joined as a party and if the central bank as an institution was not joined as a party, the position of the law is clear that the original jurisdiction of the Supreme Court cannot be properly invoked.

“So we have given considerations to diverse issues, inclusive of the issue of jurisdiction, and come Wednesday we will argue the case from that perspective, among others.”

Malami added, “I think (that) what we are talking about is not whether the ruling is binding or not binding, we are talking about what we intend to do, there is no doubt about the fact that the ruling of the Supreme Court, regardless of the prevailing circumstances, is binding and then within the context of the rule of law.

“You can equally take steps that are available to you within the context of the spirit and circumstances of the rule of law.

“And what we are doing in essence is in compliance with the rule of law both in terms of obedience to the ruling and in terms of challenging the ruling by way of putting across our own side of the story, putting across our case, challenging jurisdiction.

“So the issue of obedience to the ruling of the Supreme Court is out of it. We are wholeheartedly in agreement that naturally, we are bound by it and will comply accordingly. But within the context of compliance, we shall challenge the ruling by way of filing an application seeking for it to be set aside, it is all about the rule of law.”

Specifically, the federal government, in its preliminary objection to the suit, insisted that the Supreme Court lacked the necessary jurisdiction to entertain the suit in the first place.It was the argument of the federal government that the agency (CBN), whose Act was being complained about by the plaintiffs, was a statutory body with legal personality that could sue and be sued in its name.

In the Notice of Preliminary Objection filed by its lawyers, Mr Mahmud Magaji, SAN, and Tijanni Gazali, the respondent claimed that the suit of the three states ought to have been instituted before a Federal High Court and not the Supreme Court, as done by the plaintiffs.

Besides, the respondent argued that “the plaintiffs have equally not shown reasonable cause of action” against it.In the 11 grounds of objection to the suit, the respondent stated that the plaintiffs were challenging the powers of the Federal Government of Nigeria through its agency, the CBN, to withdraw old banknotes and introduce new ones.

The AGF further posited that the plaintiffs’ suit was about the powers vested on the CBN by the CBN’s 2007 Act to call in its banknotes and introduce new ones.

The respondent also submitted that the suit as presently constituted fell under Section 251(1)(a)(p)(q) & (r) of the Constitution (exclusive jurisdiction of the Federal High Court) by virtue of the subject matter and parties.

While describing the instant suit as an abuse of judicial process, the AGF urged the apex court to strike out the suit in the interest of justice, adding that the plaintiffs will not be prejudiced if the preliminary objection is upheld.

The respondent submitted, “The plaintiffs have no grievance whatsoever against the Federation of Nigeria. This suit has disclosed no dispute that invokes this court’s original jurisdiction as constitutionally defined.

“This suit is an abuse of judicial process. The plaintiffs have no locus standi to institute this action. The plaintiffs have no reasonable cause of action against the defendant.”

Among the issues raised for determination are: whether having regard to the facts, it is the Federal High Court and not the Supreme Court that is vested with the exclusive jurisdiction to entertain this suit?

“Whether the provisions of Sections 17, 18 and 20(3) of the Central Bank (Establishment) Act, Laws of the Federation of Nigeria, 2004 to do not exclude the jurisdiction of the Supreme Court in view of the reliefs claimed?

“Whether the plaintiffs have the locus standi to institute this suit and have disclosed any cause of action against the Defendant.”

In the event the issues raised are decided in favour of the federal government, then the apex court should make an order striking out the suit, the respondent sought.

The reasons presented by the federal government as to why the court should set aside its ruling were contained in a preliminary objection to the suit filed by filed Mr. Mahmud Magaji and Tijanni Gazali, lawyers representing the AGF, who is the sole respondent in the suit.

CBN Attributes Scarcity of New Banknotes to Hoarding

The CBN attributed the continued scarcity of new naira banknotes to hoarding by certain persons in the country.

Director, Consumer Protection, CBN Ilorin Branch, Mrs. Rashidat Mongunu, made the disclosure during monitoring exercises of some microfinance banks at Offa, the headquarters of Offa Local Government Area of Kwara State.

The monitoring team first paid homage to the Olofa of Offa, Oba Mufutau Gbadamosi, before heading to Stockcorp Microfinance Bank and Ibolo Microfinance Bank.

Mrs. Rashidat Mongunu said the redesigned notes were already made available by the CBN, “but it is those hoarding it that makes it look scarce and people now throng banks to collect money almost at the same time.”

She said, “Because of the attitude of some Nigerians in hoarding the money, even those that don’t really need the money are rushing to get it and keep, not to spend.

“Currency management is a cycle, but we have not allowed the cycle to mature, because when you issue out currency as CBN, what we expect is that the naira issued out will come back into the banking system again.

“But now, everybody collecting the naira is hoarding it. So, no matter how much naira we put out there, if we continue with this attitude and the CBN issue from now till December, it will still not be enough.

“And you know that in every economy, you must have a proper accountability on the indent.

“You just don’t issue out naira for the fun of it, you issue the amount that is commensurate with the level of activity you have in that country”, Mrs. Mongunu said.

The CBN director added that the situation could only get better when people start spending money already hoarded because enough money was already in circulation.

Mongunu said, “There is naira out there, I have been in Kwara for over three weeks and we have been allocating money daily.

“The truth is that if the currency is circulating the way it should and not being hoarded, we shouldn’t have a problem.

“The only thing is for us to change our attitude because it can only get better when people start spending the money they have hoarded.”

She added that the CBN was already engaging traditional rulers to sensitive their people to have a positive attitude and be confident that the naira redesign policy was not to punish anyone but to better the economy.

In his remarks, the Olofa of Offa, Oba Gbadamosi, said the extension of the legality of the old notes from January 31 to February 10 was responsible for the problems people were facing currently.

He said people had already deposited all that they had on them as of January 30, in anticipation of spending the new notes on February 1, hoping that it would be available, but it was not so.

The traditional ruler advised that if the CBN wanted the policy to be successful, it should make the new notes available for people to spend.

Federal Capital Territory (FCT) Abuja Residents Reject Old Naira Notes

In a related development, The Street Reporters Newspaper reports that residents of the Federal Capital Territory (FCT), Abuja, began rejecting the old naira notes for payment.

Findings by the online news portal showed that most taxi and commuter bus drivers insisted on the the new naira notes for payment of transport fares amid confusion over uncertainties surrounding the deadline for the swapping the old naira notes for new ones.

Some filling stations refused to accept the old naira notes despite the persisting scarcity of the new naira notes in the FCT.

Many residents were seen at several Automated Teller Machines (ATMs) in the Central Business District of the FCT queueing to make withdrawals.

Our correspondent who visited some banks observed that some banks had no cash to dispense. They simply turned back their customers, asking them to check back.