Summary of 20 Mind-blowing Recommendations from Presidential Fiscal Policy and Tax Reforms Committee

This post has already been read at least 111356 times!

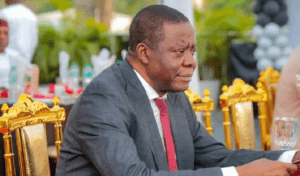

The Mr Taiwo Oyedele led Presidential Fiscal Policy and Tax Reforms Committee, have made 20 key recommendations considered to be bold and audacious aimed at transforming the Nigerian business environment and economic landscape.

If implemented, these recommendations will have far-reaching economic implications; The Street Reporters Newspaper presents a summary of the policy proposals.

Contents

Change the Name of FIRS to NRS

The committee recommends that the Federal Inland Revenue Service, F.I.R.S, the statutory body responsible for tax collection and administration, be changed to the Nigeria Revenue Service.

It also recommends that the 36 State Revenue Services should serve as departments under the Nigeria Revenue Service.

Reduce Revenue Collecting Agencies to One

Recognizing the complexities posed by numerous revenue-collecting agencies, including regulators that should be fostering a conducive business environment, the Committee proposes a consolidation. It suggests that Nigeria should streamline its revenue collection under a single agency, the Nigeria Revenue Service.

This will enable efficiency in revenue collection and boost the country’s fiscal space.

Reducing The Number of Taxes from Single-Digit

The Committee has a clear target of taking Nigeria to a single-digit tax space from over 60 taxes and levies that have been overbearing on the business environment.

It has recommended eight (8) taxes, including income tax, value-added tax, property tax, customs duties, excise tax, stamp duties, special levy, harmonised levy, and social security contribution (not a tax).

This is guided by the principles of eliminating nuisance taxes with very low revenue yield, focusing on high revenue-yielding taxes, merging taxes and levies that are imposed on similar tax bases, keeping the number of taxes across all levels of government in single digits, and institutionalising the tax harmonisation reform to ensure sustainability.

Summary of the 20 Key Recommendations

Here’s a summary of 20 key recommendations from the Presidential Fiscal Policy and Tax Reforms Committee in Nigeria:

- Public Service Efficiency:

Measures to eliminate duplication of functions, ensure prudent financial management, and optimize value from government assets and natural resources. - Inter-Agency Collaboration:

Strengthening policy signaling and collaboration between Ministries, Departments, and Agencies (MDAs). - Tax Net Expansion:

Leveraging technology with the “Data4Tax” initiative to broaden the tax base. - Tax Relief for Individuals:

Increasing the personal income tax exempt threshold and personal relief allowances. - Support for Low-Income Earners:

Tax breaks for the private sector concerning wage increases for low-income earners and transport subsidies. - Forex Transactions:

Permitting taxes on foreign currency-denominated transactions in Naira for Nigerian businesses. - Global Employment Opportunities:

Removing barriers to global employment opportunities for Nigerians based in Nigeria. - Energy Sector Incentives:

Suspension of VAT on diesel and tax waivers on CNG, CNG conversion, and renewable energy items. - Tariff Review: A comprehensive review of tariffs on certain items and a fiscal policy review of other items prohibited for imports.

- Tax Regulation Reforms:

Simplification of Withholding Tax Regulations to ease the pressure on the working capital of businesses. - Digital Cash Transfers:

Facilitating the use of mobile phones for conditional cash transfers. - Spending Framework:

Introducing a spending framework for subsidy removal and forex reform windfalls, including a national portal to track government spending. - Multiple Tax Suspension:

Suspending multiple taxes that burden the poor and small businesses. - Forex Market Expansion:

Expanding the official foreign exchange market to include BDCs, forex apps, and retail fx dealers, and outlawing transactions in the black market. - Digital Currency and Forex Management:

The committee recommends digitalizing Nigeria’s forex regime to discourage speculative demands and hoarding of forex in cash. - Excise Tax on Forex Transactions:

An imposition of excise tax on foreign exchange transactions conducted outside the official market is proposed. - Forward Contracts for Fuel Imports: Implementing forward contracts for the importation of Premium Motor Spirit (PMS) as a short-term measure pending improvement in key economic indices.

- Streamlining Forex Processes: The discontinuation of the FX verification portal and the requirement for a Certificate of Capital Importation, as well as export proceeds restrictions, are suggested.

- Export Promotion:

Addressing impediments to export promotion and bottlenecks regarding Export Expansion Grants, and removing restrictions on repatriation and use of export proceeds by exporters. - Waiver of Penalty and Interests:

The 20th and final key recommendation from the Presidential Fiscal Policy and Tax Reforms Committee is focused on providing relief for outstanding tax liabilities. It suggests a waiver of penalty and interests on the condition that full payment of outstanding tax liabilities is made on or before December 31, 2023. This measure is intended to encourage compliance and ease the financial burden on taxpayers, thereby improving the overall tax collection process.

These 20 recommendations designed to address critical economic issues such as exchange rate management, the impact of fuel subsidy removal, moderation of inflation, and facilitating economic growth.

The committee’s report reflects a strategic approach to reforming Nigeria’s fiscal policy and tax system to promote economic transformation and development.The Mr Taiwo Oyedele led Presidential Fiscal Policy and Tax Reforms Committee, have made 20 key recommendations considered to be bold and audacious aimed at transforming the Nigerian business environment and economic landscape.

This post has already been read at least 111356 times!